No More Freeriding on the Great American Drug Deal

A new article by Peter Kolchinsky and Richard Z. Xie published in RApport introduces the Freeriding Index, quantifying how much wealthy countries underpay for innovative medicines—by as much as 60% less than fair market value when adjusted for income.

Titled “No More Freeriding: The Great American Drug Deal,” the piece reveals the hidden costs of global price disparities: Americans shoulder a disproportionate share of biomedical R&D while trade competitors benefit without paying their fair share.

Key Takeaways

The authors argue that:

Price control proposals like “Most Favored Nation” (MFN) threaten U.S. innovation and patient access.

Instead, smart trade policy should demand that other wealthy nations open their markets and pay their fair share.

Brand medicines in the U.S. already offer ~70% value discounts relative to the benefits they deliver.

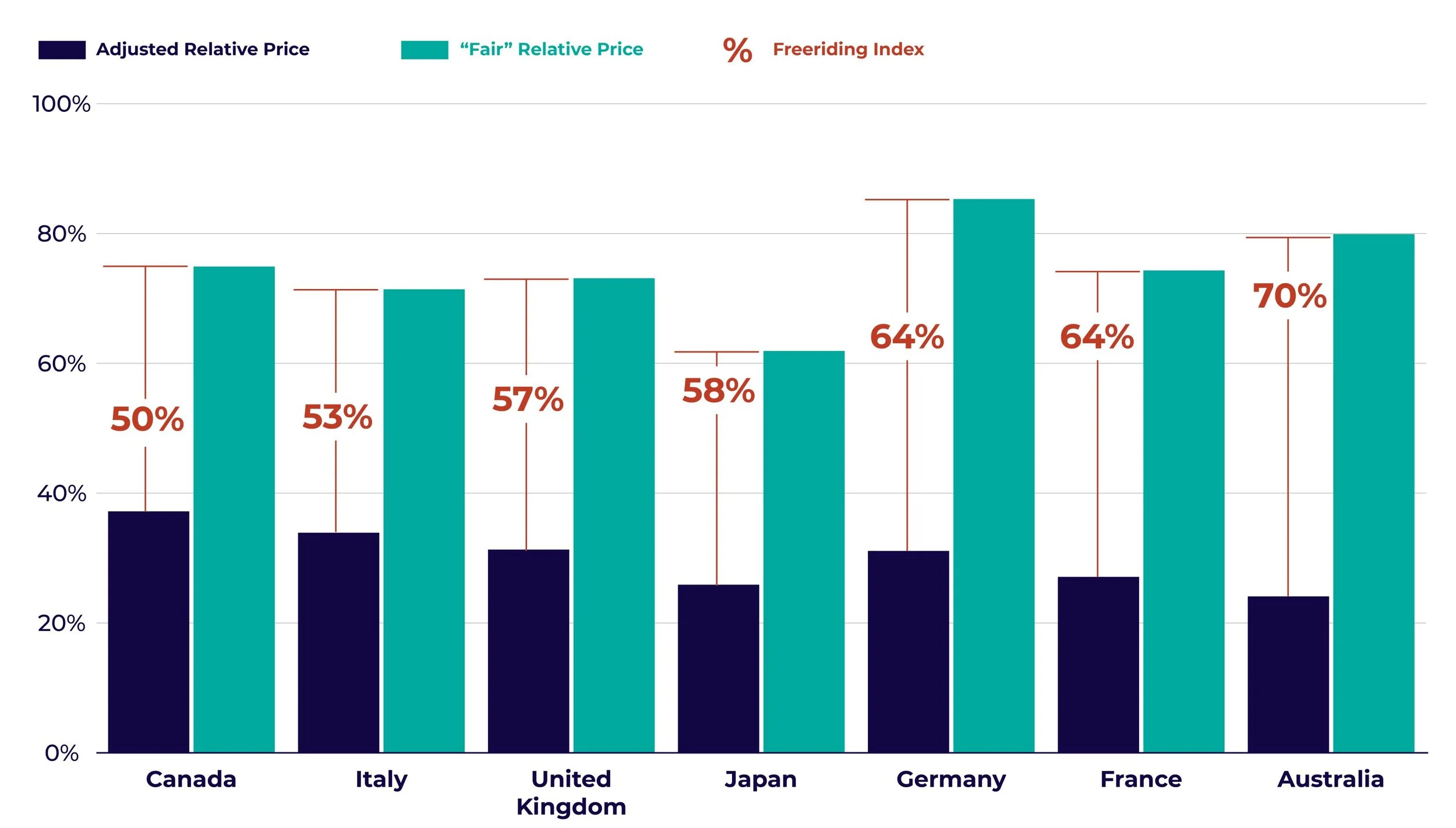

Figure 1: The Freerider Index

Figure 1 plots adjusted relative price vs “Fair” relative price, sorted by increasing GDP per capita PPP, and tracks our basket of branded drugs only. SOURCE: RAND, CIA, RA Capital Management. The Freeriding Index is shown for each country and measures the percent by which the Adjusted Relative Price is lower than the “Fair” Relative Price.

By addressing this imbalance, we can:

✔️ Expand global R&D capacity

✔️ Promote market competition and affordability

✔️ Reduce long-term healthcare costs worldwide

Read the full article on RApport: No More Freeriding on the Great American Drug Deal